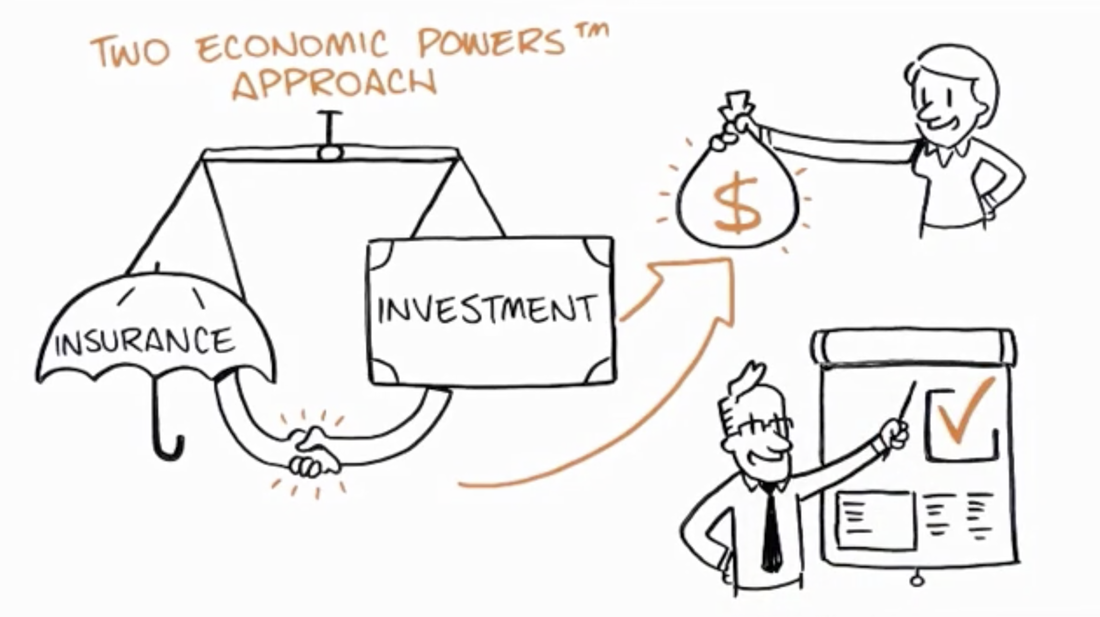

The Two Economic Powers

(you're probably not using one of them)

(you're probably not using one of them)

There seems to be two competing philosophies within the financial industry:

- Buy the cheapest insurance and invest the majority of your savings.

- Avoid the risks of investing and put all of your savings into insurance products with guarantees.

We can prove it to you, but these articles are a good place to start your education: